The strength of WHOI's science is in its people.

—Henry Bryant Bigelow, founding director of WHOI, 1930-1940

—Henry Bryant Bigelow, founding director of WHOI, 1930-1940

Make a difference. Every day.

Be a part of something bigger—the ocean. The ocean covers more than 70 percent of the Earth's surface and is the reason why life exists on our planet.

Help us explore and learn more about the ocean and the many mysteries it holds.

Internal Candidate? Click here to apply.

Need help? Learn how to apply.

More than a job

Discovery and innovation are not the only things we do well at WHOI.

Our people also benefit from being part of an organization that cares about its employees, local community, and the world around us.

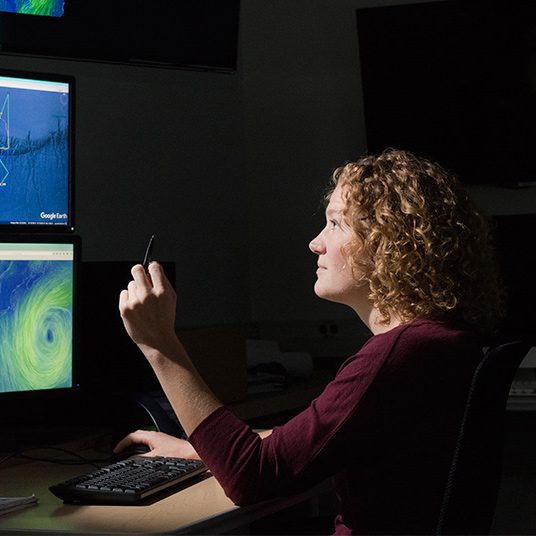

Humans of WHOI