Putting science to work for Massachusetts coastal communities

A part of the NOAA-funded National Sea Grant Program, Woods Hole Sea Grant supports coastal communities through research, extension and education.

Our mission is to enhance the practical use and conservation of coastal and marine resources by developing and sharing science-based knowledge to create a sustainable economy and environment for the diverse communities of Massachusetts.

"What makes Sea Grant unique is that it facilitates the transfer of scientific results so that people can use it. And it provides a great opportunity to support fundamental science."

- Jeff Donnelly, Senior Scientist, Woods Hole Oceanographic Institution

"I always bring back something to use in the classroom--lessons, videos, ideas, or actual physical artifacts. These workshops have strengthened my teaching and bring excitement to the subject matter."

- Middle school teacher, a participant in the WHSG Topics in Oceanography workshops

“Sea Grant has been a hugely impactful program for guiding my research focus over the past several years. It has provided ... a great opportunity to produce fundamental research in coastal marine ecology while working and communicating with local communities and industry stakeholders who rely on coastal ecosystem health, especially in the Cape Cod and Islands region.”

- Jeanette Wheeler, MIT-WHOI Joint Program graduate

“Woods Hole Sea Grant’s ongoing efforts to support our industry’s remarkable growth--through water quality and disease monitoring--have proved crucial time and again."

- Chris Sherman, Island Creek Oyster

"Woods Hole Sea Grant has enabled the Kelp Ecosystem Ecology Network (KEEN) to get off the ground and expand. Without the funding from WHSG we wouldn’t be able to expand our efforts in New England. It’s been incredibly valuable and useful." - Jarrett Byrnes, assistant professor of biology, UMass Boston

“Sea Grant is seminal – the grants may be modest but they help generate preliminary data and fundamental improvements to a regional issue that can then leap frog into something with even more funding and significance." - Scott Lindell, research specialist, Woods Hole Oceanographic Institution

Research

Woods Hole Sea Grant supports scientists from institutions throughout Massachusetts and beyond, conducting research in the areas of marine life, coastal processes, hazards, energy sources, climate change, stormwater management and tourism.

Extension

Woods Hole Sea Grant and the Cape Cod Cooperative Extension are partnered to provide reliable technical and science‐based information on fisheries and aquaculture and coastal processes and hazards to distinct stakeholders within our region.

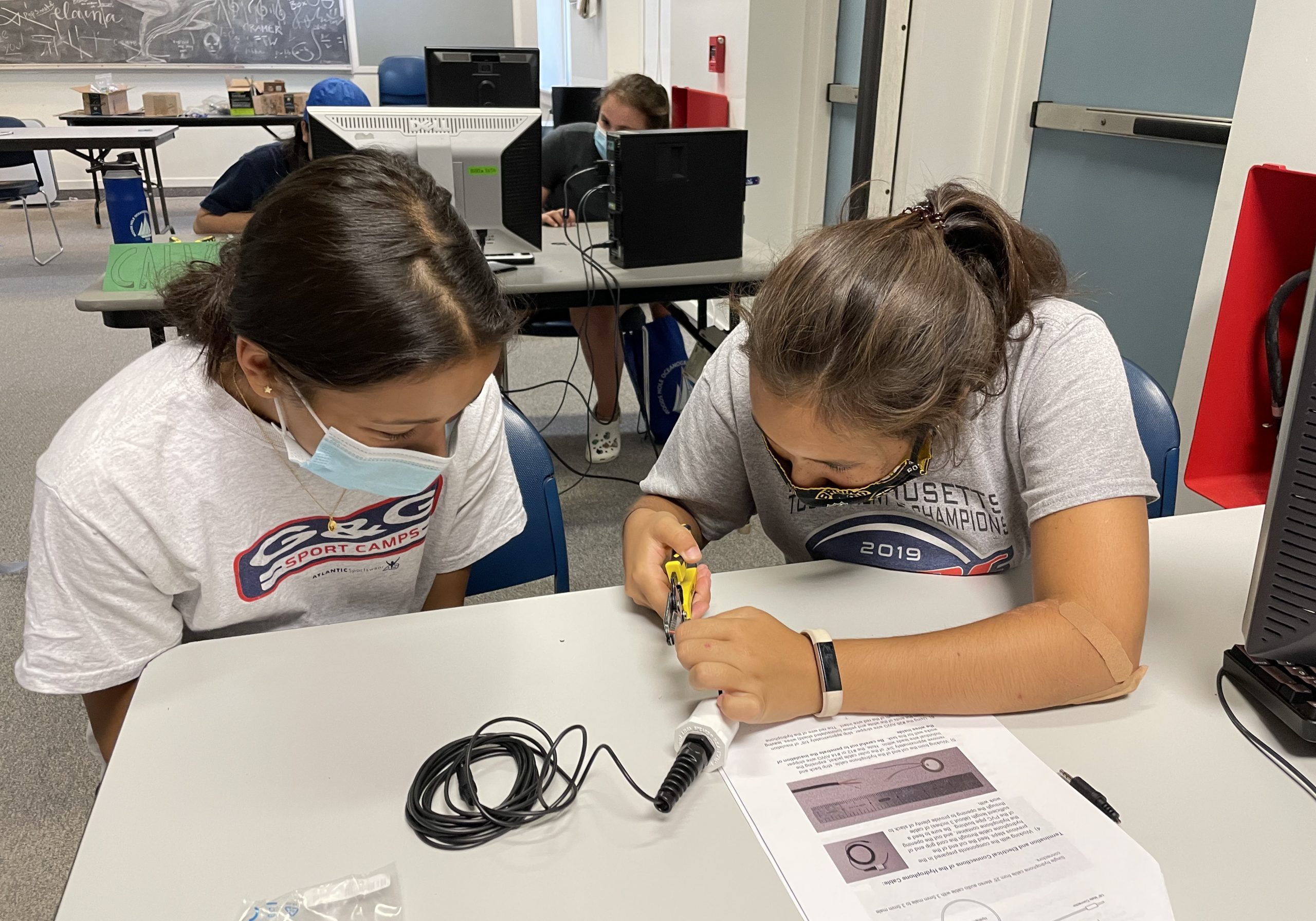

Education

Sea Grant educators and communicators provide valuable leadership in marine and aquatic science education activities for K‐8 students, professional development workshops for educators, and public education and outreach in coastal communities.

Updates and Events

Massachusetts Aquaculture Internships

The Massachusetts aquaculture industry is in search of staff who are reliable and willing to learn. Aquaculture Internships for Massachusetts (AIM), a collaborative partnership MIT Sea Grant, WHOI Sea Grant, and Barnstable County Cooperative Extension, pays individuals to learn about…

Read More2024 Knauss Fellowship Finalists

WHOI Sea Grant is proud to sponsor two successful Knauss Fellowship finalists. The finalists will begin their fellowship placements in 2024. Jordanna Barley Barley is a student in Organismic and Evolutionary Biology program at UMass Amherst, working with Dr.…

Read MoreWHOI Sea Grant to Map Potential Path of Proposed Wastewater Release from Pilgrim Nuclear Power Station

Woods Hole Oceanographic Institution (WHOI) Sea Grant has been recommended for rapid response funding from the National Oceanic and Atmospheric Administration (NOAA) Sea Grant Program to study the pathways of circulation in Cape Cod Bay. This study is designed to…

Read MoreCARE for the Cape & Islands and WHOI Sea Grant Funded to Reduce Single-Use Plastic

Cape Cod Coalition to Aid Tourism Business Shift to Sustainable Serviceware CARE for the Cape & Islands and WHOI Sea Grant have been awarded a $299,999 grant to address the problem of single-use plastics used in tourism-based food and hospitality…

Read More